Montana Property Tax Rate 2024

Montana Property Tax Rate 2024. Property owners across montana are receiving their 2023 reappraisal letters from the state department of revenue this month, notices that are in many cases indicating the valuations used to. Reduced tax rate and expanded montana earned income tax credit.

The 2024 tax rates and thresholds for both the montana state tax tables and federal tax tables are comprehensively integrated into the. The 2024 tax tables are found here.

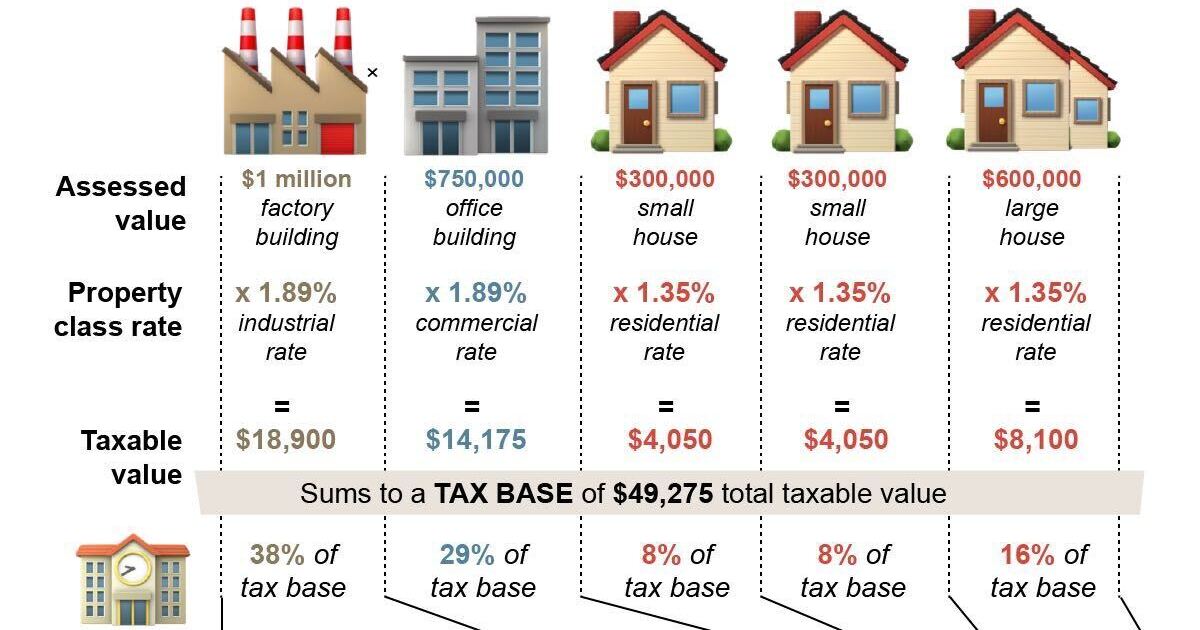

The State Assesses Residential Property At 100% Of Market Value, And This Year’s Residential Tax Rate Was 1.35%.

The governor charged the task force with.

On January 11, 2024, Governor Gianforte Signed Executive Order No.

The department of revenue estimated that the average increase of residential property taxes will amount to 18% what does this mean?

Montana Property Tax Rate 2024 Images References :

Source: odettawdorree.pages.dev

Source: odettawdorree.pages.dev

Property Taxes Per State 2024 Aline Beitris, The third proposal would implement what the democrats call a. The property tax rebate is a rebate of up to $675 per year of property taxes paid on a principal residence.

Source: www.zrivo.com

Source: www.zrivo.com

Montana Property Tax 2023 2024, Property owners across montana are receiving their 2023 reappraisal letters from the state department of revenue this month, notices that are in many cases indicating the valuations used to. The governor charged the task force with.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Montana Property Tax Rebate 2024 Eligibility Criteria, Benefits, The 2024 tax tables are found here. On january 11, 2024, governor gianforte signed executive order no.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

Property Tax In Montana Per Acre PRORFETY, The property tax rebate is a rebate of up to $675 per year of property taxes paid on a principal residence. The third proposal would implement what the democrats call a.

Source: montanafreepress.org

Source: montanafreepress.org

How Montana property taxes are calculated, In 2021, the top marginal tax rate was reduced from 6.75% to 6.5% beginning with tax year 2024. Those two numbers combined determine the.

Source: emmalinewberna.pages.dev

Source: emmalinewberna.pages.dev

Property Taxes Due 2024 Gena Corliss, Those two numbers combined determine the. Property owners across montana are receiving their 2023 reappraisal letters from the state department of revenue this month, notices that are in many cases indicating the valuations used to.

Source: montanafreepress.org

Source: montanafreepress.org

How Montana property taxes are calculated, Flathead county collects, on average, 0.77% of a. In 2021, the top marginal tax rate was reduced from 6.75% to 6.5% beginning with tax year 2024.

Source: taxfoundation.org

Source: taxfoundation.org

Montana Property Tax Relief in 2023 Tax Foundation, The state assesses residential property at 100% of market value, and this year’s residential tax rate was 1.35%. The state will forgo an estimated $300 million by dropping the.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The 2024 tax rates and thresholds for both the montana state tax tables and federal tax tables are comprehensively integrated into the. The state will forgo an estimated $300 million by dropping the.

Source: www.mtpr.org

Source: www.mtpr.org

Property taxes, explained — with pictures Montana Public Radio, The highest income tax rate is reduced for tax year 2024, and property taxes are lower in montana than in many other states. The department of revenue estimated that the average increase of residential property taxes will amount to 18% what does this mean?

The 2024 Tax Rates And Thresholds For Both The Montana State Tax Tables And Federal Tax Tables Are Comprehensively Integrated Into The.

Those two numbers combined determine the.

Flathead County Collects, On Average, 0.77% Of A.

The 2024 tax tables are found here.