Tax Form For Electric Vehicle

Tax Form For Electric Vehicle. Electric vehicle (ev) tax credits for 2022 and 2023. Visit fueleconomy.gov for a list of qualified vehicles.

If you haven’t previously entered this credit information for the current asset: Electric vehicle (ev) tax credits for 2022 and 2023.

Not Only Are They Environmentally Friendly, But They Also Have Tax Benefits.

Visit fueleconomy.gov for a list of qualified vehicles.

The Ev Tax Credit Income Limit For Married Couples Filing Jointly Is $300,000.

If you haven’t previously entered this credit information for the current asset:

The Ev Tax Credit Is A Federal Incentive To Encourage Consumers To Purchase Evs.

Images References :

Source: www.formsbirds.com

Source: www.formsbirds.com

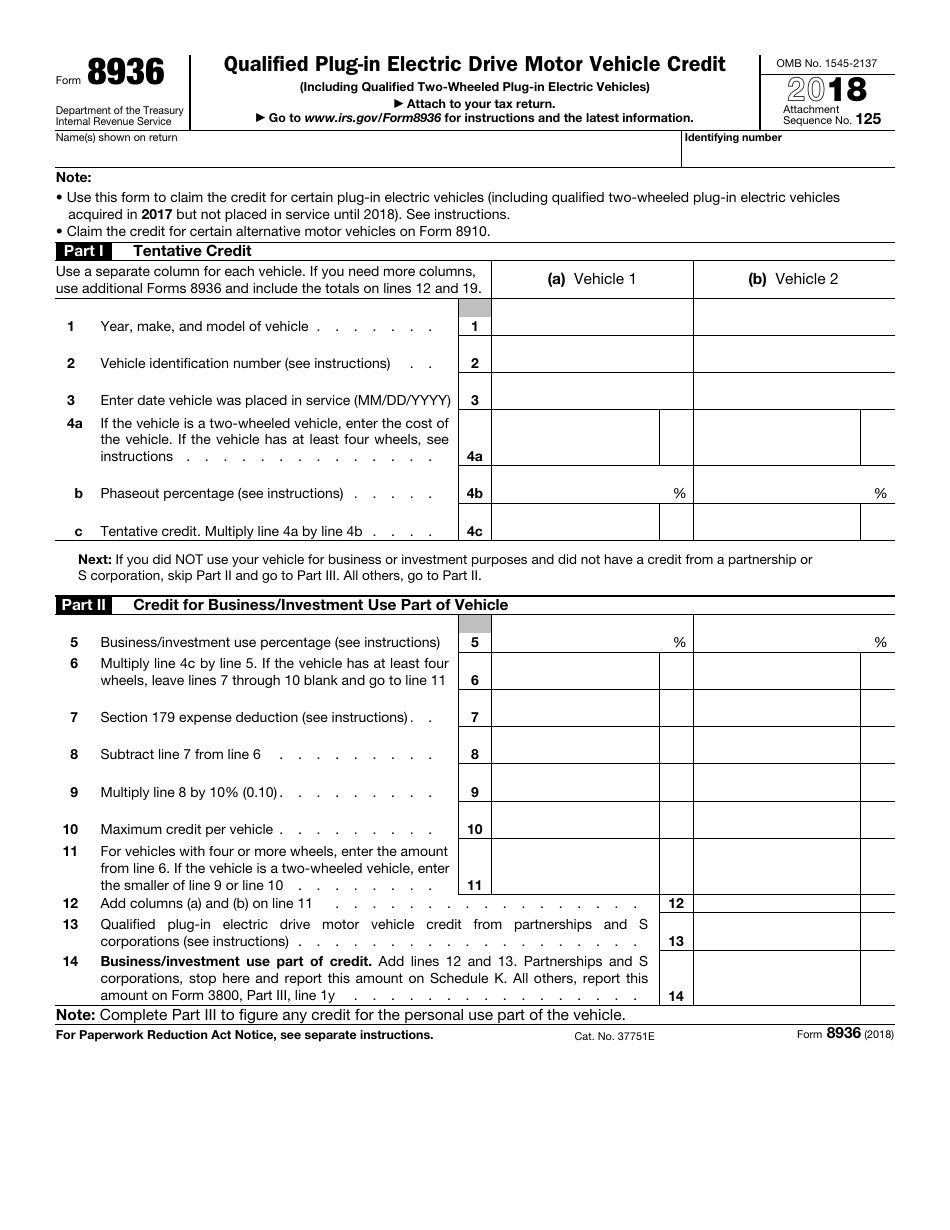

Form 8936 Qualified Plugin Electric Drive Motor Vehicle Credit (2014, You can use form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those.

Source: mypoisonedapple.blogspot.com

Source: mypoisonedapple.blogspot.com

Electric Vehicle Tax Credit Irs Electric Vehicle Tax Credit What To, You can use form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year. Not only are they environmentally friendly, but they also have tax benefits.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, Electric vehicle (ev) tax credits for 2022 and 2023. Taxpayers who meet the income requirements and buy a vehicle that satisfies the.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those. Taxpayers who meet the income requirements and buy a vehicle that satisfies the.

Source: www.pdffiller.com

Source: www.pdffiller.com

2018 Form IRS 8862 Fill Online, Printable, Fillable, Blank pdfFiller, To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those. The irs has set a handful of requirements a person must meet to qualify for the electric vehicle tax credit, including.

Audi, MINI & Toyota Prius models added to IRS electric vehicle tax, And, if you file as head of household and make more than $225,000, you also won’t be. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, And, if you file as head of household and make more than $225,000, you also won’t be. Follow the steps for 1 of these options:

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, And, if you file as head of household and make more than $225,000, you also won’t be. The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering multiple.

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What, The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering multiple. First, make sure you meet the requirement set by the irs.

Source: go-charge.co.uk

Source: go-charge.co.uk

Company Car Tax Benefits for Electric Vehicles Go Electric, First, make sure you meet the requirement set by the irs. Not only are they environmentally friendly, but they also have tax benefits.

You Can Use Form 8936 To Claim An Electric Vehicle Tax Credit For Vehicles Purchased And Placed Into Service During The Current Tax Year.

To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new resources today to help those.

The Ev Tax Credit Income Limit For Married Couples Filing Jointly Is $300,000.

Taxpayers who meet the income requirements and buy a vehicle that satisfies the.